- #Tax Cuts And Job Act S Corporation 20% Update Their Conformity#

- #Tax Cuts And Job Act S Corporation 20% Free Distributions From#

Despite the rhetoric about simplifying the Internal Revenue Code (IRC), the TCJA did just the opposite — it added layers of new complexity for many taxpayers.Sales to non co-op: 20 percent pass-through deduction based upon the net. 115- 97, which was enacted in December, contained the most sweeping federal tax law changes in more than 30 years. This generally means greater simplicity in corporate taxation and considerable tax savings (an estimated 40.3 billion over a 10-year period, according to the Joint Committee on Taxation).The tax law known as the Tax Cuts and Jobs Act (TCJA), P.L. The Tax Cuts and Jobs Act repealed the corporate AMT for all C corporations for tax years beginning after December 31, 2017.

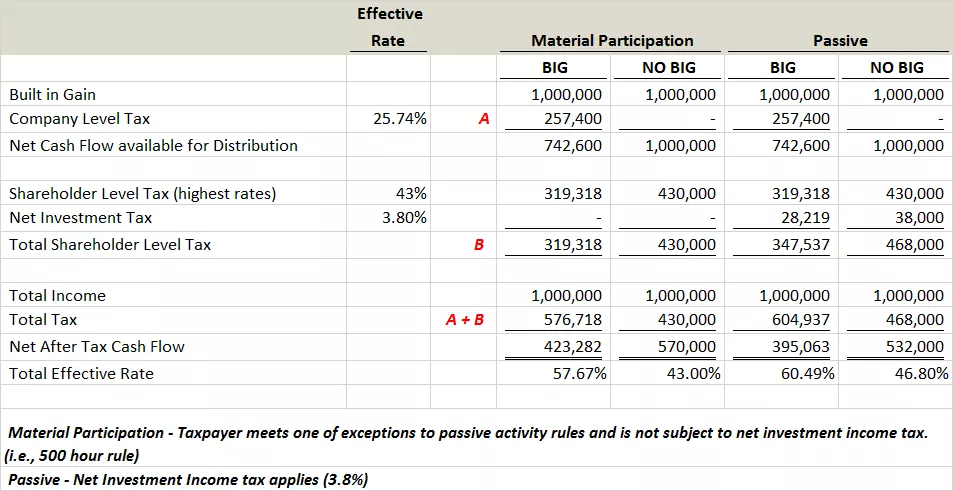

(For a more comprehensive discussion of the TCJA's provisions, see Nevius, "Congress Enacts Tax Reform," 225- 2 Journal of Accountancy 52 (February 2018), Unless indicated otherwise, these changes became effective Jan. Summary of federal changesBelow is a summary of some of the TCJA provisions that may affect state tax filings. This column provides an overview of state tax considerations resulting from the TCJA and the status of states' legislative responses. The Tax Cut and Jobs Act (TCJA) reduced the top corporate income tax rate from 35 percent to 21 percent, bringing the US rate below the average for most other Organisation for Economic Co-operation and Development countries, and eliminated the graduated corporate rate schedule (table 1).The TCJA creates a new deduction for passthrough business income (section 199A) that is generally equal to 20 percent of qualified business income (QBI).The federal complexity is matched by uncertainty regarding how state legislatures and taxing authorities will respond.

Only home-equity loan interest on loans used for improvements to a home is deductible. 15 to buy a home and met certain other requirements. 15, 2017, and for individuals who signed a binding contract before Dec. The pre-TCJA cap still applies for mortgage loans existing prior to Dec.

Owners of other (nonpersonal service) businesses do not face the phaseout but are subject to potential reductions of the benefit. The deduction for income from certain personal service businesses will be entirely phased out if the owner's taxable income exceeds specified thresholds. The deduction is available for individuals, estates, and trusts, and excludes wages and guaranteed payments received from the flowthrough entity. Owners of flowthrough entities including S corporations, partnerships, and sole proprietors engaged in a qualified trade or business may deduct 20% of their shares of the qualified business income (QBI) from the flowthrough entities. Moving expense reimbursements are now includible in gross income and wages, other than reimbursements to a member of the military on active duty who moves pursuant to a military order. Moving expenses are deductible only by members of the armed forces on active duty who move pursuant to a military order and incident to a permanent change of station.

For corporations, this income will be taxed at either 8% or 15.5%, but through the complex use of restricted deductions, the effective individual rates generally will be somewhat higher. Shareholders of specified foreign corporations must include in income a "deemed repatriation dividend." The deemed dividend is the shareholder's pro rata share of the corporation's post-1986 accumulated earnings and profits. For the last tax year beginning before Jan. Interestingly, the federal tax return's placement of this deduction (presumably post-AGI, but before itemized deductions) may have an impact on state taxes, as discussed below.

Tax Cuts And Job Act S Corporation 20% Free Distributions From

Businesses with average gross receipts for the prior three tax years of greater than $25 million are subject to limitations on the deduction for business interest. Tax-free distributions from a Sec. 529 education savings plan of up to $10,000 per year, per recipient can now be used toward tuition at elementary and secondary schools, including religious or other private schools. It is paid separately and electronically it cannot be combined with, or paid as part of, any standard income tax paid with a taxpayer's tax return or extension. This tax is due regardless of whether cash is actually repatriated.

For more, see Lady, "The New GILTI and Repatriation Taxes: Issues for Flowthroughs," on p. (The TCJA includes other complex foreign tax provisions that are beyond the scope of this column. Corporations must recognize the deemed-dividend repatriation for the last tax year beginning before Jan. And, with very few exceptions, NOLs can offset only up to 80% of the taxpayer's taxable income in the year to which the loss is carried. Net operating losses (NOLs) can no longer be carried back, but the carryforward period is indefinite (vs.

179 deduction is increased to $1 million, and the phaseout begins at costs exceeding $2.5 million.The fiscal impacts that will be felt by the states and their residents as a result of the TCJA's provisions depend on multiple factors, including how the state conforms to the IRC and what starting point (federal AGI, taxable income, etc.) is used by the state in calculating taxable income.All states that impose an individual and/or corporate income tax conform to the IRC to some degree, and some states follow different methods for individual vs. The bonus percentage decreases beginning in 2023 and expires after 2026. 50%) applies to the qualifying costs of property put in service after Sept.

For example, some states with rolling conformity may specifically address in their statutes the standard deduction and personal exemption amounts, how NOLs are calculated, and how bonus depreciation is treated.Nineteen states currently have "static" conformity for individual income taxes, and 21 states follow this approach for corporate income taxes. These states must take legislative action to decouple from specific provisions not already addressed in their statutes. Rolling conformity is used in 18 states and the District of Columbia for individual income taxes, and in 22 states for corporate taxes. When the IRC is amended, states' laws automatically conform to the relevant provisions.

Tax Cuts And Job Act S Corporation 20% Update Their Conformity

For example, New Jersey does not start with federal AGI when calculating its gross income tax. In these states, rather than conforming to the IRC as of a specific date, the state's tax statutes incorporate or reference specific IRC sections. Many states routinely update their conformity dates when the IRC is amended.The IRC is incorporated by specific reference in five states for individual income tax purposes and three states for corporate income tax purposes. When the IRC is amended, a state using static conformity may update its conformity date or may incorporate specific provisions of the federal changes.

The federal rate that applies to the deemed dividend is lower than standard tax rates, including the long-term capital gain rate. Will the state permit the payment of the tax to be spread over a number of years? If not, an individual taxpayer in Connecticut, for example, who is taxed at the 2017 top marginal rate of 6.99% and reports a federal deemed dividend of $1 million could potentially face additional Connecticut income tax of $69,900. For individuals in states with rolling conformity, presumably the deemed dividend will be included in the calculation of the state taxable income. Corporation Income Tax Return, as the starting point for calculating state taxable income 16 states use line 30 of Form 1120 (federal taxable income) as the starting point.A number of new federal provisions do not lend themselves well to predictable state treatment. Taxpayers in states that use a starting point other than federal taxable income may not benefit from the new flowthrough- entity deduction, absent state legislation.With regard to corporate tax, 22 states use line 28 (before NOLs and special deductions) of federal Form 1120, U.S. Colorado and North Dakota use rolling conformity, which means that unless they specifically decouple from the new flowthrough- entity deduction discussed above, this deduction presumably will reduce their individual income tax bases.

0 kommentar(er)

0 kommentar(er)